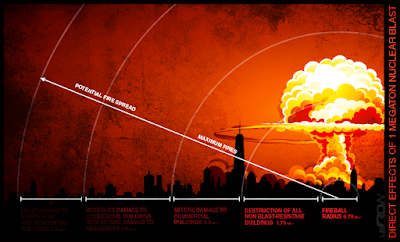

A nuclear explosion releases energy in four pulses - (1) Blast, (2) Thermal radiation, (3) Ionising radiation, and (4) Residual radiation

There are reports from major Indian cities that the queues at banks and ATMs have greatly reduced, and that one can walk up to an ATM and withdraw the new 500 rupee note without any delay. With this, many observers feel, the worst of the demonetisation pain is over, and the country will shortly return to normal.

Nothing could be further from the truth. In fact, the worst is yet to come. The optimism is a delusion of those living in a metropolitan bubble.

What has eased is the "first order" effect of demonetisation - the shortage of cash. If the government had prepared adequately for the demonetisation exercise by having sufficient stocks of 100 rupee notes and new 500 rupee notes to exchange, and had been able to effect the exchange within two weeks, the ill-effects could have been contained fairly easily. However, the significant duration that it has taken for this problem to abate (two months) has created second order problems, which in turn will create third order problems.

What are these second order and third order problems?

Second order problems are supply-chain disruptions. Third-order problems relate to reduced credit.

These are the two second order problems.

1. Agricultural shortfall and food price inflation

The demonetisation shock hit just when farmers were in the middle of buying seeds to plant the Rabi crop. Part of the planting had happened, but the latter half was disrupted. The Rabi harvest is due in Feb-March, so the shortfall is going to be seen when the crop reaches the market. Food price inflation will start in April 2017.

2. Massive unemployment in the small-scale and unorganised sectors

At least 35% unemployment has already been reported. Migrant labourers have left for their villages to better ride out the storm through subsistence farming. Factories and shops have closed.

Many of the closures will be permanent because creditors will have to be paid, forcing asset sell-offs. Therefore, unemployment will not ease significantly in the short term.

These two conditions together are known as stagflation, which is what India is heading towards.

But this is not all. When farmers and small enterprises suffer sustained operating losses, they lose their ability to repay their loans. This then translates into the following third order effects.

1. Increased NPAs at banks and reduced credit capacity

As loans to small businesses and farmers turn bad, banks will suffer increasing proportions of Non-Performing Assets (NPAs). This will curtail their ability to offer credit, ensuring a prolonged recession.

2. Reduced foreign investment

As the banking sector weakens, the country's sovereign rating could also be downgraded. This will make it harder to attract foreign investment, further dampening growth prospects and prolonging the recession.

Summary

In short, India is likely to see the second order impact around April 2017 in the form of rising prices and widespread unemployment in the small-scale and unorganised sectors. The second half of 2017 will see the start of a prolonged recession, which is the third order effect.

Two people deserve to be marched from their desks in disgrace - Prime Minister Narendra Modi and RBI Governor Urjit Patel. Modi's feat will have been as a turnaround manager. He will have turned a boom into a full-blown recession in about 6 months. Urjit Patel will be remembered as the man who could not say no.

Update 14/01/2017: I have created a cartoon mashup to illustrate what I think will happen.

Update 14/01/2017: I have created a cartoon mashup to illustrate what I think will happen.

1 comment:

Bro I think you need to correct your statistics and data, or I would say wake up to reality .

Post a Comment